SINGAPORE – Financial institutions here are starting to jump on the green vehicle plateau, with at least two entry-level companies related to electric cars.

When the US electric car manufacturer Tesla’s sales portal went live in Singapore last week, it turned out that the company had won DBS Bank as a preferred partner for loans.

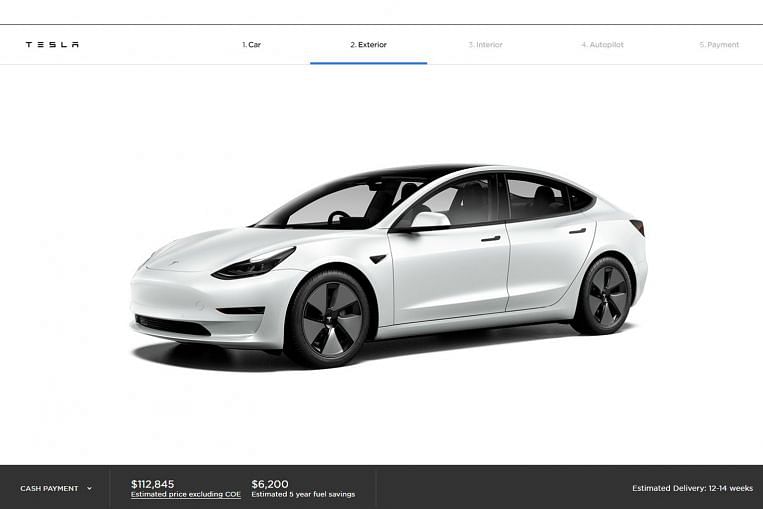

A Tesla website in Singapore reported no down payment and an effective interest rate of 3.2 percent. This raised eyebrows as it appeared to violate a policy by the Monetary Authority of Singapore that limited car loans to no more than 70 percent of the vehicle sales price.

When contacted on Monday (February 15), a DBS spokesman said that loans to Tesla buyers would follow MAS guidelines and that Tesla was “in the process of changing this on its website”.

In a separate statement Monday, DBS said it was tapping into a growth segment – green car loans. The bank said the rate on its green car loan is “currently the lowest in the industry … to encourage Singapore car owners to reduce their carbon footprint.” The effective interest rate of the DBS for non-electrified cars is 0.57 points higher at 3.77 percent.

The loan is available from March 1st and applies to the purchase of new and used electric and hybrid vehicles. It added that for every customer who takes out the new green loan, the bank will make a donation to plant trees as part of the National Parks Board’s OneMillionTrees movement.

In the meantime, OCBC Bank has partnered with Charge + – an electric vehicle (EV) charging infrastructure provider – to “accelerate the greening of Singapore’s land transport sector”.

The two have signed a letter of intent, and OCBC will “use its extensive coverage of the real estate sector to encourage its developer and landowner customers to install charging points on their premises.”

In addition, the two parties will develop incentives to encourage OCBC customers to buy electric vehicles and recharge at Charge + charging points, the bank said in a statement on Monday.

When asked what financial benefits it hopes to gain from the association, an OCBC spokesman said the bank would help fund the introduction of charging points for electric vehicles and that it would come with “interest and fees.”

“By entering the ecosystem, we hope to be able to offer the same type of banking support to other companies joining the ecosystem in the future,” added the spokesman.

The move is in line with OCBC’s goal of building a $ 25 billion sustainable finance portfolio by 2025 – a goal announced last June.

Charge + plans to build 10,000 charging points for electric vehicles across the island by 2030. The company has identified condominiums as suitable locations for this.

When contacted, leading auto loan company Hong Leong Finance only said it was in talks with Tesla to offer “competitive loan packages”.